The Control-Alt-Backspace Upgrade Strategy: Hardware

This is part one of a two-part series on my strategy for when and how to upgrade hardware and software for maximum effectiveness and minimum bother. We’ll start with hardware, because we can’t use any software in the first place if we don’t have good hardware! Next week we’ll move on to software.

Goals

I have three goals for my hardware upgrades, roughly in order:

- Always (or as much as possible) have devices that work excellently for me. My computing devices are the tools of my trade, and they’re not that expensive, so I don’t compromise.

- Spend as little money and consume as few resources as reasonably possible while still having excellent devices.

- Spend as little time as possible researching and setting up devices while still meeting the two goals above, because that time is time I could instead be spending doing useful or entertaining things on those devices. (If you enjoy just making expensive tech purchasing decisions that you’re pretty likely to regret, maybe you should become a tech writer and get paid to do it!)

In the next section, I present the strategy I’ve developed to meet those goals, across the life cycle of Research, Purchase, and Use and the two supplementary steps of Recycle and Save. This strategy doesn’t yield the best results, nor is it the most trouble-free, nor is it the cheapest, nor is it the fastest; instead, it’s a reasonable balance of all of these things that I’ve found easy, effective, and rewarding. I think that makes it a good approach for a wide variety of people with a variety of needs.

However, it will be unsuitable for some who need to place a higher-than-average priority on one of these factors. In particular, if you prioritize saving money above all other factors, either in absolute terms or because your cash flow is insufficient to purchase an expensive device all at once, this is probably not the best strategy for you. It does perform better on that front than many other strategies because it recommends upgrading only rarely; for example, amortized costs over the expected life of my iPhone XS, which some people consider an expensive luxury device, run only $20/month, on par with or less than the cost for many people’s “cheap” phones due to their rapid upgrade cycles (see the Save section for calculations). But if you’re willing to concede significant amounts of time and trouble, buying a series of old, cast-off devices and keeping them for a year or two each will keep you in working devices for cheaper – though you’re likely to get some lemons in the process, and you run a greater risk of getting a device with malware or some other nasty surprise on it from its past life.

Strategy Lifecycle

Research

When it comes time to upgrade or you’re thinking about buying an entirely new type of device, spend some time learning about what the market is like now. If you follow the other parts of the strategy, it’s been long enough since you’ve been seriously researching that your basic assumptions might not be true anymore. Identify your requirements on paper. Consider whether you still need the type of device you’re trying to replace or whether it could be served by a different type of device now (e.g., most people don’t need a standalone GPS unit for their car anymore). If you do need the device, start looking at your options there. Staying with the same brand or platform as before can help save time and narrow your many choices, so it’s a useful strategy, but sometimes your initial market research might suggest a change is better.

Purchase

Don’t cheap out on a new device. Buy new or certified refurbished, and get the latest model you can. This way, it will have more years before it’s too old to keep up with the world and will continue to meet your needs for longer. Plus, you’ll enjoy it more at the beginning. One exception: avoid brand-new, first-generation technology that has yet to be proven (say, the first iPhone, the first smartwatch, the first Windows Phone, the first Palm PDA…you get the idea). Unless you enjoy doing it, let someone else work the bugs out, and if you still want the device by the next year, buy the second generation.

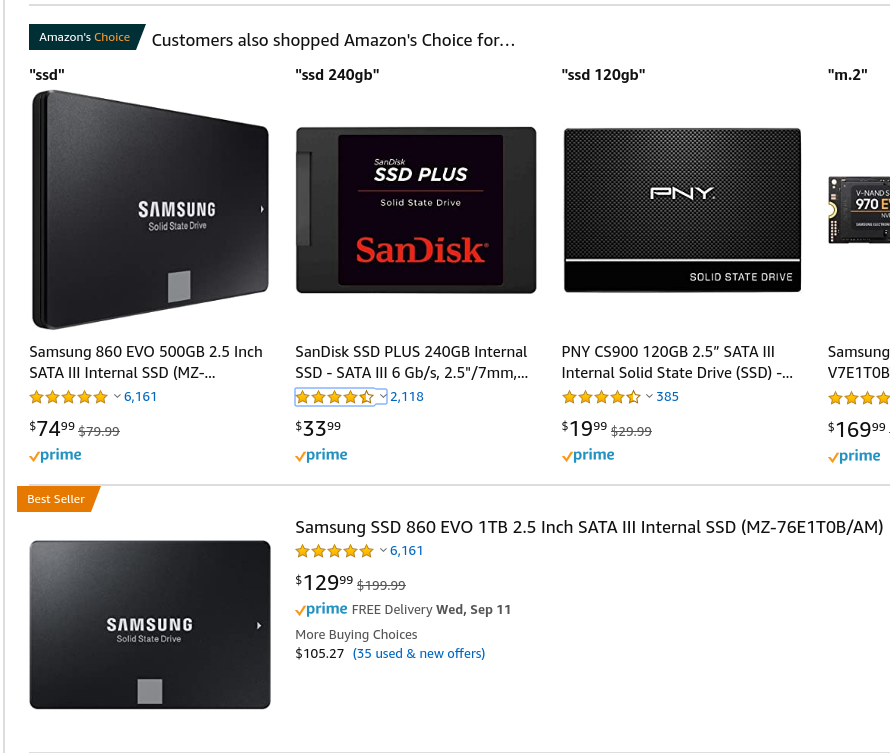

When choosing between similar models, buy in or slightly above the sweet spot – the point where the additional quality you get for each additional dollar spent starts to drop off rapidly. The sweet spot is easily defined in hard drives, where it tends to move up one level of capacity every couple of years and is a great way to make decisions about how much space to buy. Take a look at the solid-state drives available on Amazon right now:

In real life, you might not want to compare multiple brands randomly juxtaposed, but it will do for demonstration purposes. You can see that by jumping from 120GB to 240GB, you get twice the capacity for less than twice the price. From 240GB to 500GB, you get roughly twice the capacity for roughly twice the price. From 500GB to 1TB (i.e., 1000GB), you again get twice the capacity for less than twice the price.

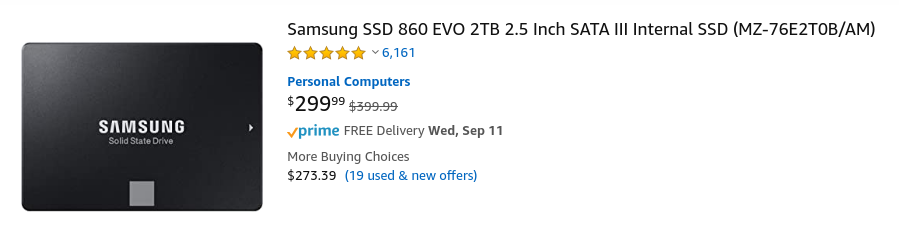

But if we look up 2TB drives, suddenly we are paying considerably more than twice the price for twice the capacity, and that’s when it’s $100 off from list:

So 1TB is the sweet spot. Unless you need more than 1TB, or you’re certain you need far less, it makes sense to buy 1TB: up to that point, your dollars scale linearly and you can be assured of having enough space into the future without paying too much. After that point, you start paying for the privilege of having a big hard drive rather than for the space itself. When dealing with devices other than hard drives, you might be paying extra for a brand name or “cool factor,” for a useful but gimmicky feature (e.g., the Touch Bar on new MacBooks), or for slightly more computational power you may not need.

Unless you’re unusually accident-prone or the device you’re buying is known for being unreliable (in which case, don’t buy it!), skip the extended warranty or accidental damage coverage. If you’re worried about breaking your device, use the money you would have spent on the warranty towards saving for your new one instead (see below). If worst comes to worst, you can put the money towards repairing it and pay much less out of pocket, and if, as is likely, you don’t need repairs during the warranty period, the money can go towards your next purchase.

Recycle

If your old device still works but just didn’t meet your needs anymore, see if you can get rid of it by selling or giving it to a friend or posting it on a classified list. Someone who has lesser needs or means than you will appreciate a cheap or free device. Don’t keep it around “in case you need it someday”; you’re just going to clutter up your house with old devices you never use, and nobody else will ever get to use it.

Use

Take care of your device as well as you can without being unreasonable about it (for the latter, see Apple’s care instructions for its new credit card). Keep using it as long as it meets your needs. The longer you can keep your device, the better: that saves you money, it saves you time researching and reduces the risk you switch to a device you don’t like, and it saves the environment from being damaged to create more phones. Upgrading just because there’s something new is unnecessary as long as what you have still meets your needs.

If there’s something you can do to upgrade or repair your device so it keeps meeting your needs for another couple of years, that’s a good deal. But if you’re spending money on an upgrade or repair that still only makes the device sort of meet your needs or will only last a few months, it’s time to look into a replacement.

How long you can use your device before you have to restart the cycle depends on the device, the way the world develops, and often some plain dumb luck, but I like to shoot for 7 years. For most devices, that’s entirely doable even for a heavy-use tech guy if you choose quality, up-to-date products. If your needs are minimal, you might even be able to get away with 10 years on some products, though people might be making fun of you by the end!

Try not to worry about new devices and new developments too much. Once in a while a truly killer feature might come out that could save you so much time or money it’s worth upgrading just for that, but you’ll hear about it without trying if that’s the case. Ignoring new developments focuses your attention on things that matter more and prevents you from getting caught up in hype and buying new devices when your old ones still do everything you want them to.

Save

This part is optional, but it’s worth thinking about.

Because my strategy has you lay out large amounts of money for each device on the promise that you’ll spend less energy, time, and money in the long run, it can be valuable to pay into a savings account during the life of each device. This eliminates the outlay next time and frees your upgrade decisions from your cash flow: around when it’s time to upgrade your device, the money is sitting there ready for you, and you complete your upgrade whenever it makes logical and market sense instead of when you have the money. When you’re dealing with long upgrade timelines, the monthly amount can be surprisingly affordable (and you aren’t charging yourself exorbitant interest rates like the people who usually say those words). The downside is that inflation means you end up effectively spending slightly more money over finding the cash and buying the device when it comes time.

Here’s how: I recently bought a new iPhone. Let’s pretend I just bought it (it’s actually been a month or two). I paid roughly $1,300 for it, I expect the price of an iPhone will be reasonably steady, and I’m expecting it’ll last me 6 years (my last iPhone did).

First we want to adjust the price for inflation, because an equivalent iPhone will be going for more dollars in 6 years even if its real value hasn’t changed. Of course this is not an exact science; if I could accurately predict market data like the inflation rate over the next 6 years, I’d be a billionaire! The interest in my savings account will help me keep up with inflation, so I’ll reduce my guesstimate of the actual inflation rate to an effective inflation rate of 1.5% over the next 6 years and calculate as follows:

If I pay into my savings account in accordance with this figure as described below, I’ll have somewhat more than $1,420 in there 6 years from now, since I’ll be earning interest on what I deposit. If my estimates and assumptions were right, that larger amount will pay for my new iPhone. Even if my assumptions were wrong, it will likely be close enough unless something really crazy happens.

With the inflation adjustment complete, we just divide by 72 (6 years times 12 months), for $19.72. I set up a recurring monthly transfer with my bank for $19.72, and I’m set. You may want to either open a separate account or use a spreadsheet or some other means of keeping track of what that money in your savings account is assigned to, to make sure you don’t forget by the time you need your upgrade.